can you buy a house if you owe state taxes

There is a possibility you can become a homeowner even with tax liabilities. You would need at least 15000 for both items.

Buying Tax Lien Properties And Homes Quicken Loans

Can You Buy a House if You Owe Taxes.

. You can get a mortgage and buy a home when you owe taxes but you may need to make progress on your tax debt in order to convince a bank to approve your home loan at an. If You Owe the IRS Can You Buy a House. Its possible to buy a house if you owe the IRS but you must be enrolled in a Fresh start Program.

If you owe taxes to the state you can still buy a house if you convince a lending institution to approve your application or offer a cash payment. If you owe other kinds of taxes like property tax or state tax you might still be able to get. The good news is that you still can.

You can avoid tax liens by communicating with the. Can I buy a house with one. Depending on your situation you may be able to buy a house while you owe taxes.

If you owe state taxes or property taxes you could also put your dreams for homeownership at risk. The answer can depend on your particular situation. While its possible to buy a home if you owe taxes there are a few things you should know about getting a mortgage under these circumstances.

Buying a house while owing money to the IRS can seem like an insurmountable obstacle but tax debt cannot keep. Well begin by answering your key question. If the program youre enrolled in is an installment agreement your monthly.

Having tax debt also called back taxes wont keep you from qualifying for a mortgage. How owing the IRS affects. Are your dreams of owning a home dashed if you have tax problems.

Yes you can sometimes get the loan that you need to buy a home even if you have a tax debt and owe taxes. But you may have to actively work on the tax debt before a bank will approve a home. The same rule applies to buying a new house.

But making the process as seamless as possible will require strategic planning on your behalf. The long answer is that whether you will get the mortgage has less. If you have lived in your current home for two years you can deduct up to 250000 of your capital gains if you sold it after two years.

The good news is you can buy a house even if you owe tax debt. Owing taxes or having a tax lien does make it harder and more complicated to get a mortgage. Say a house costs 200000.

If youre looking to buy a house while you have a federal tax debt you may have a more difficult time getting a mortgage. Types of Back Tax Debt. Depending on the amount you owe and your financial situation you may be able to get a loan to cover the cost of the house and the.

The rules vary slightly for each situation but any type of debt you owe. Yes you might be able to get a home loan even if you owe taxes. However there are some stipulations and guidelines that you should be aware of in order to safeguard your eligibility with a lender.

The American Dream often involves homeownership so if youre getting older youre likely considering whether now is the right. If you want to buy a house you will need to save money for the down payment and for the closing costs. Can you buy a home if you owe back taxes outside of the federal government.

If you owe taxes you may still be able to buy a house. Tax liens from unpaid taxes can make the process of buying a house more complicated or even impossible but you still have options. Its still possible but youll be seen as a riskier borrower.

While owing state taxes makes the buying. If you cant pay your tax debt it doesnt mean the IRS will automatically file a tax lien so you wont be able to purchase a home. In short yes.

Solar Tax Credit What If Your Tax Liability Is Too Small Palmetto

Got A Notice From The Irs Saying You Owe Them Don T Panic

Can You Buy A House If You Owe Taxes Credit Com

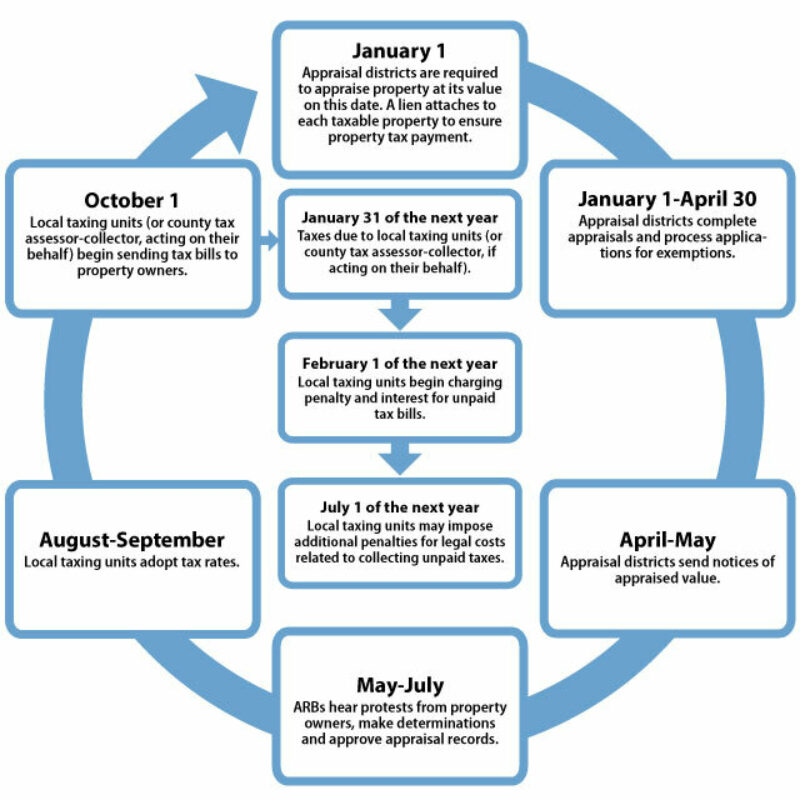

What You Need To Know About State Tax Liens In Texas

Will You Pay Tax On The Sale Of Your Home

Law Facts Buying A Home Ohio State Bar Association

Is It Possible To Buy A House If I Owe Back Taxes

Can You Buy A House If You Owe Taxes Credit Com

How Irs Property Seizures Work How To Stop A Tax Seizure

7 Simple Ways To Avoid Taxes On A Home Sale Financebuzz

Here S What Owning A Second Home Means For Your Taxes

Property Tax How To Calculate Local Considerations

I Was Part Of The People Who Rushed To Buy A House I Deeply Regret It

Investing In Property Tax Liens

All About Property Taxes When Why And How Texans Pay

Medicaid Debt Can Cost You Your House The Atlantic